Discover the Best Payroll App for Android

Managing payroll can be a daunting task, especially for small business owners. However, with the advent of technology, there are now numerous payroll apps available for Android that can simplify this process. In this blog article, we will explore the best payroll app for Android that will streamline your payroll management, save you time, and ensure accuracy in your financial transactions.

Whether you are an entrepreneur, a freelancer, or a small business owner, finding the right payroll app for your Android device is crucial. With so many options available in the market, it can be overwhelming to make a choice. That's why we have done the research for you and compiled a comprehensive list of the best payroll apps for Android that will cater to your specific needs and requirements.

1. Payroll App A: Streamline Your Payroll Management

This section will introduce the first payroll app on our list. We will discuss its features, user interface, and how it can simplify your payroll management process. This app provides seamless integration with your Android device and offers a range of functionalities to streamline your payroll tasks.

2. Payroll App B: Automate Payroll Calculations with Ease

Here, we will delve into the second best payroll app for Android. We will highlight its key features, such as automated payroll calculations and tax calculations. This app aims to simplify the complex calculations involved in payroll processing, ensuring accuracy and efficiency.

3. Payroll App C: Generate Comprehensive Payroll Reports

This section will focus on the third payroll app on our list. We will discuss how this app can generate detailed payroll reports, including employee salary statements, tax reports, and more. With this app, you can easily access and analyze your payroll data, helping you make informed financial decisions.

4. Payroll App D: Ensure Compliance with Tax Regulations

Here, we will explore a payroll app that prioritizes compliance with tax regulations. We will discuss how this app keeps you updated with the latest tax laws, automates tax calculations, and generates tax forms. This ensures that your payroll processes adhere to legal requirements and minimizes the risk of penalties.

5. Payroll App E: Secure and Confidential Payroll Management

In this section, we will discuss a payroll app that emphasizes data security and confidentiality. We will explain the app's encryption measures, secure cloud storage, and access controls. This app ensures that your sensitive payroll information remains protected from unauthorized access.

6. Payroll App F: Easy Integration with Accounting Software

Here, we will introduce a payroll app that seamlessly integrates with popular accounting software. We will discuss how this app simplifies the transfer of payroll data to your accounting software, minimizing manual data entry and potential errors. This integration streamlines your financial processes and enhances accuracy.

7. Payroll App G: User-Friendly Interface for Intuitive Navigation

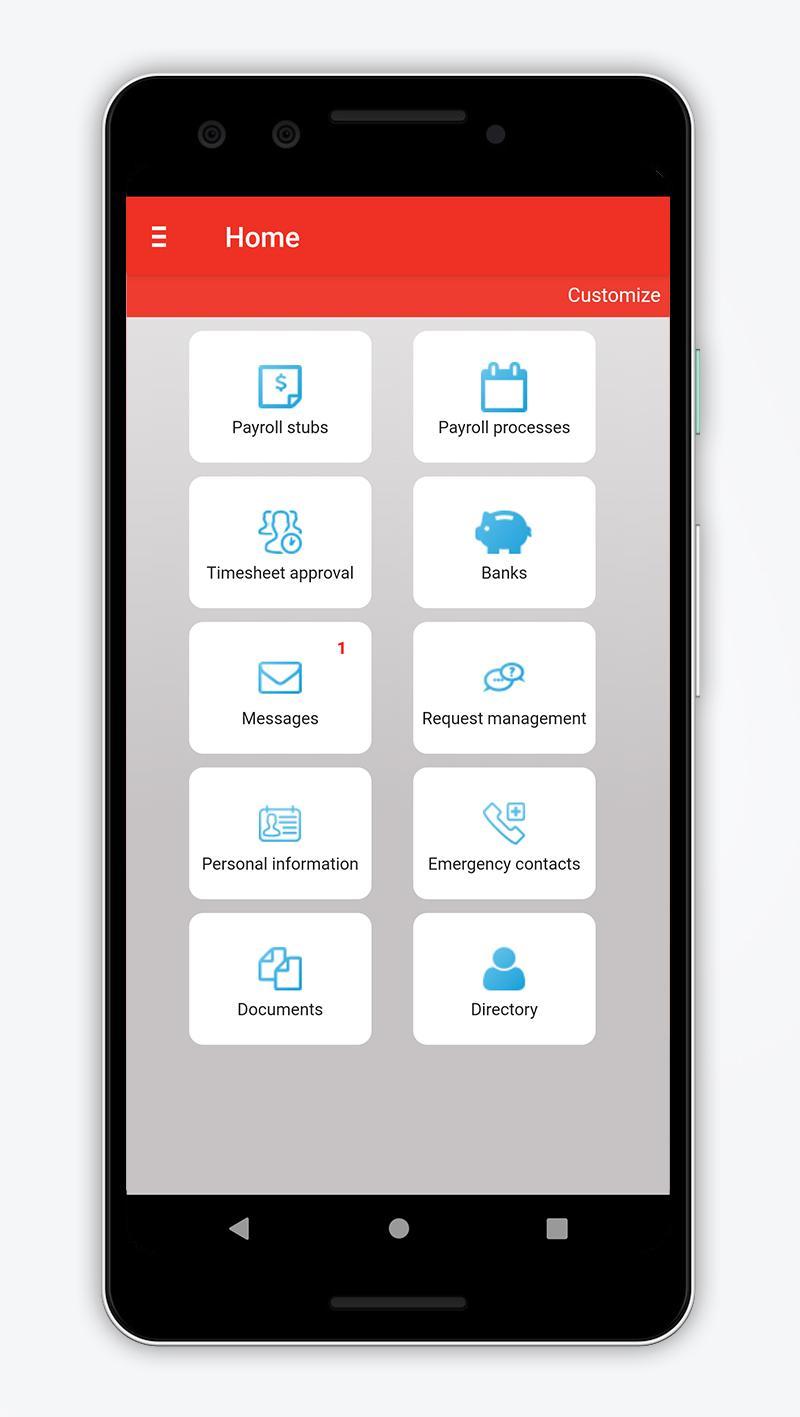

This section will focus on a payroll app that boasts a user-friendly interface, making it easy to navigate and operate. We will discuss its intuitive design, interactive dashboards, and step-by-step guidance. This app ensures a smooth user experience, even for those with minimal technical knowledge.

8. Payroll App H: Time and Attendance Tracking Made Effortless

Here, we will explore a payroll app that incorporates time and attendance tracking features. We will discuss how this app allows employees to log their work hours, tracks overtime, and calculates accurate wages based on time records. This feature ensures fair compensation and simplifies payroll processing.

9. Payroll App I: Customizable Payroll Settings to Suit Your Needs

In this section, we will discuss a payroll app that offers customizable settings to cater to your unique requirements. We will explore the app's flexibility in terms of salary structures, deductions, allowances, and tax settings. This app ensures that your payroll processes align with your specific business needs.

10. Payroll App J: Cost-effective Solution for Small Businesses

Here, we will highlight a payroll app that offers a cost-effective solution for small businesses. We will discuss its pricing plans, affordability, and value for money. This app provides all the essential payroll features without burdening your budget, making it ideal for startups and small enterprises.

In conclusion, finding the best payroll app for your Android device is essential to streamline your payroll management processes. The apps mentioned in this article offer a range of features, such as automated calculations, comprehensive reports, tax compliance, data security, integration with accounting software, intuitive interfaces, time tracking, customization options, and cost-effectiveness. Explore these apps and choose the one that aligns with your business requirements, ensuring efficient and accurate payroll management.

Post a Comment for "Discover the Best Payroll App for Android"

Terimakasih Telah Berkunjung Di Blog Ini, Jika Merasa Artikel Bermanfaat Jangan Lupa Untuk DiShare.

Atas Kerjasamanya Admin Mengucapkan Terimakasih.

----Katingo Take----